Image Name: Blog #78: More on How to Smite a Termite

File Size: 502 x 502 pixels (31168 bytes)

Image Name: Life Insurance Taxes – Estate Taxes, Benefits, Premiums, and ...

File Size: 250 x 250 pixels (6130 bytes)

Image Name: ... to be considered group-term life (GTL) insurance for this purpose

File Size: 600 x 600 pixels (169115 bytes)

Understanding Taxes on Life Insurance Premiums

The following guide is meant to elucidate some of the tax implications surrounding life insurance premiums. A person shopping for life insurance has many things to consider before making a decision. First, there is the distinction between term life .... Jimmy Rodefer: Consider long-term care insurance: With Americans' life expectancy now at about 79 ... an unavoidable health care need helps explain why tax deductions — which many people don't know about — exist for qualified long-term care insurance. The Centers for Disease Control website explains .... SBI Life's "Saral Sanchay": A life insurance cum savings plan: Key Highlights: Life Insurance cum Savings plan with simple and easy enrolment ... Benefit, as stated above, would be payable only in case your policy is in-force at the end of the term. Tax deduction in respect of the premium paid is available under .... September set as Life Insurance Awareness Month: Life insurance proceeds can help pay immediate expenses including uncovered medical costs, funeral expenses, final estate settlement costs, taxes and other lump-sum ... family might be to take a look at term life insurance, which offers financial ...

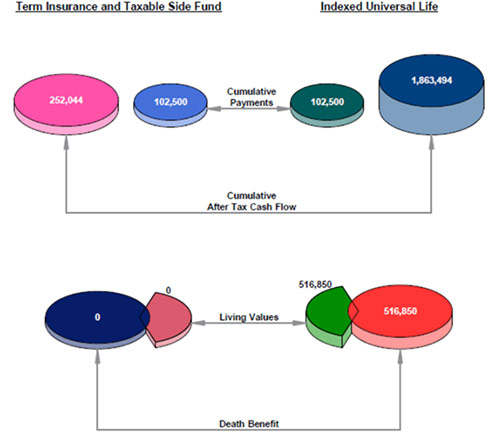

Life insurance for business owners: a multipurpose tool: To further sweeten the compensation pot for top employees, he notes, a company might offer a hybrid form of life insurance policy that comes with a long-term care rider or feature that provides the policyholder with tax-free cash to cover long-term care .... Long-Term Care Insurance: Why or Why Not?: Some policies now combine long-term care with regular life insurance. According to industry trade group ... Finally, long-term care premiums are tax deductible, up to limits set by both the federal government and state governments based on the age of .... Your Life Insurance Policy Might Be Your Best Investment Opportunity - 4%+ Tax Free: The Investment Component Of Life Insurance What a lot of people don't understand is that, with the exception of term life insurance ... which will then earn essentially tax free interest. And you can pretty much withdraw your money any time without ...

Plan today for future long-term care costs

You may be able to mitigate this somewhat by choosing a flexible policy with life insurance benefits ... On the plus side, long-term care insurance offers tax benefits. When you itemize, all or part of the premium for qualified plans are deductible .... How permanent life policy can save you money: In my last column, I discussed when the purchase of term-life insurance would be a good idea and when the ... can be handled with the tax-free death benefit that he arranges today.. Don’t avoid insurance because of the hike in service tax: If you were paying Rs 15,000 for a Rs 1 crore term insurance ... For traditional life insurance policies, the earlier rate of 3.09% has been hiked to 3.5% in the first year. For subsequent years, the tax rate has been hiked from 1.5% to 1.75%.

Image Name: Life insurance

File Size: 720 x 720 pixels (56982 bytes)

Image Name: Taxes From A To Z (2013): L Is For Life Insurance

File Size: 986 x 986 pixels (153294 bytes)

Image Name: Life Insurance Taxes – Estate Taxes, Benefits, Premiums, and ...

File Size: 250 x 250 pixels (10647 bytes)

Image Name: the amount of cover level term insurance and decreasing term insurance ...

File Size: 867 x 867 pixels (154986 bytes)

Image Name: ... the fields and controls on the Deduction Table - Tax Classpage

File Size: 864 x 864 pixels (29348 bytes)

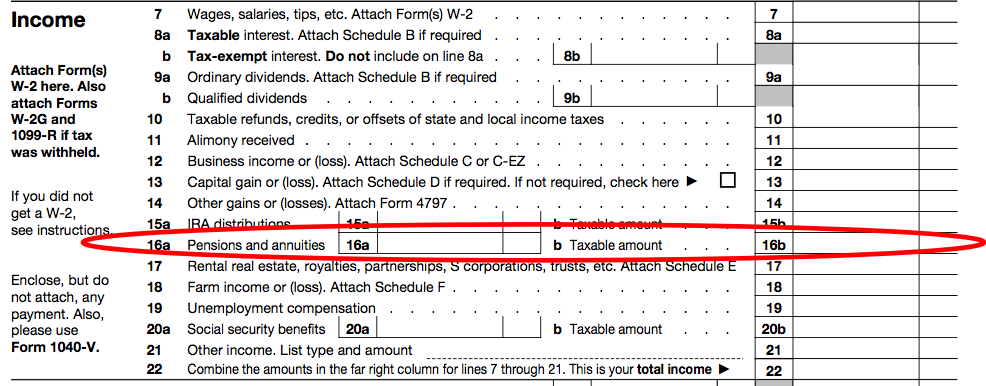

Group-Term Life Insurance - Internal Revenue Service

Group-Term Life Insurance. Total Amount of Coverage. IRC section 79 provides an exclusion for the first $50,000 of group-term life insurance coverage .... Tax advantages of term life insurance coverage: Let's look at leaving your family $500K in money/assets versus $500K as a term life benefit to see what a difference life insurance can make.. Group term life insurance payroll item setup: When employer-provided group term life insurance (GTLI) exceeds $50,000 for an employee, the value of the excess coverage (as determined by the IRS) must be reported .... How are life insurance proceeds taxed? - Investopedia: A: Generally, life insurance death benefits that are paid out to a beneficiary in lump sum are not included as income to the recipient of the life insurance payout.. Publication 525 (2014), Taxable and Nontaxable Income: See Group-Term Life Insurance, ... mineral property for the life of the ... the Railroad Unemployment Insurance Act are taxable and you must include them .... Are Insurance Benefits Taxable? | Do You Ever Owe Taxes On: Sometimes taxable. Unlike term life insurance policies, many permanent life insurance products earn dividends or interest.. How To Avoid Taxation On Life Insurance Proceeds: Life Stages; Credit ... see Buying Life Insurance: Term Versus Permanent ... For those estates that will owe taxes, whether life insurance proceeds are included as .... Taxation of Group Term Life Insurance – Suite: Group term life insurance that is provided by an employer is taxable income, and this article explains how the value of that benefit is calculated.. 10 life insurance tax facts you need to know | LifeHealthPro: Q: Is the interest increment earned on prepaid life insurance premiums taxable income? A: Yes. Any increment in the value of prepaid life insurance or .... Life Insurance Tax - Are There Taxes On Life Insurance ...: You may be wondering, Do I pay taxes on life insurance proceeds? Life insurance death benefit proceeds are usually not subject to state and federal income taxation.

Image Name: Image: How a cap and floor works. Growth potential with downside ...

File Size: 810 x 810 pixels (170170 bytes)

Image Name: article name do i have to pay taxes on life insurance payouts author ...

File Size: 600 x 600 pixels (65576 bytes)

Related Keyword:

Blog #78: More on How to Smite a Termite, Life Insurance Taxes – Estate Taxes, Benefits, Premiums, and ..., ... to be considered group-term life (GTL) insurance for this purpose, Life insurance, Taxes From A To Z (2013): L Is For Life Insurance, Life Insurance Taxes – Estate Taxes, Benefits, Premiums, and ..., the amount of cover level term insurance and decreasing term insurance ..., ... the fields and controls on the Deduction Table - Tax Classpage, Image: How a cap and floor works. Growth potential with downside ..., article name do i have to pay taxes on life insurance payouts author ....

Комментариев нет:

Отправить комментарий